There has been significant concern raised about the Indian economy by the business media and neoliberal institutions. This all began when India’s GDP growth rate for 2024 was expected to be just 6.5%. However, this does not fully explain the sudden pessimism surrounding the Indian economy. While Trump’s erratic policies certainly do not help India, the mainstream discourse is primarily focused on the ‘structural’ issues within the Indian economy.

In my previous blog, I discussed how India’s growth, driven by increasing private sector indebtedness, is unsustainable. I believe the concerns being raised in the mainstream discourse are about the same issue. It’s not just about GDP growth; in the absence of external demand and sufficient government spending, the only long-term path for an economy to grow is by increasing private sector indebtedness.

The mainstream, however, is primarily concerned with urban ‘middle-class’ consumption. Why? Because the urban ‘middle class’ is the only significant source of consumption demand (beyond essential goods) in the Indian economy. The vast majority of Indians lack sufficient purchasing power to afford anything other than essential goods, including the majority of farmers and casual workers in the country.

Until now, I have used ‘middle-class’ in quotes because, for most people, the term ‘middle-class’ typically refers to the median; what the average person earns. The problem, however, is that when the mainstream media refers to the ‘middle-class,’ they are actually talking about the top 10-20% of earners, not the middle 40%.

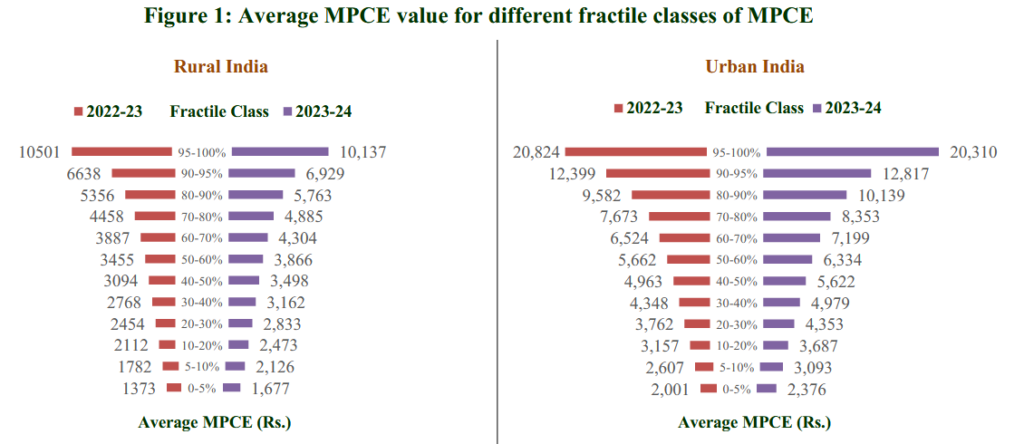

You can look at the Monthly Per Capita Consumption Expenditure (MPCE) data from the Finance Ministry to see how much each income fractile earns.1

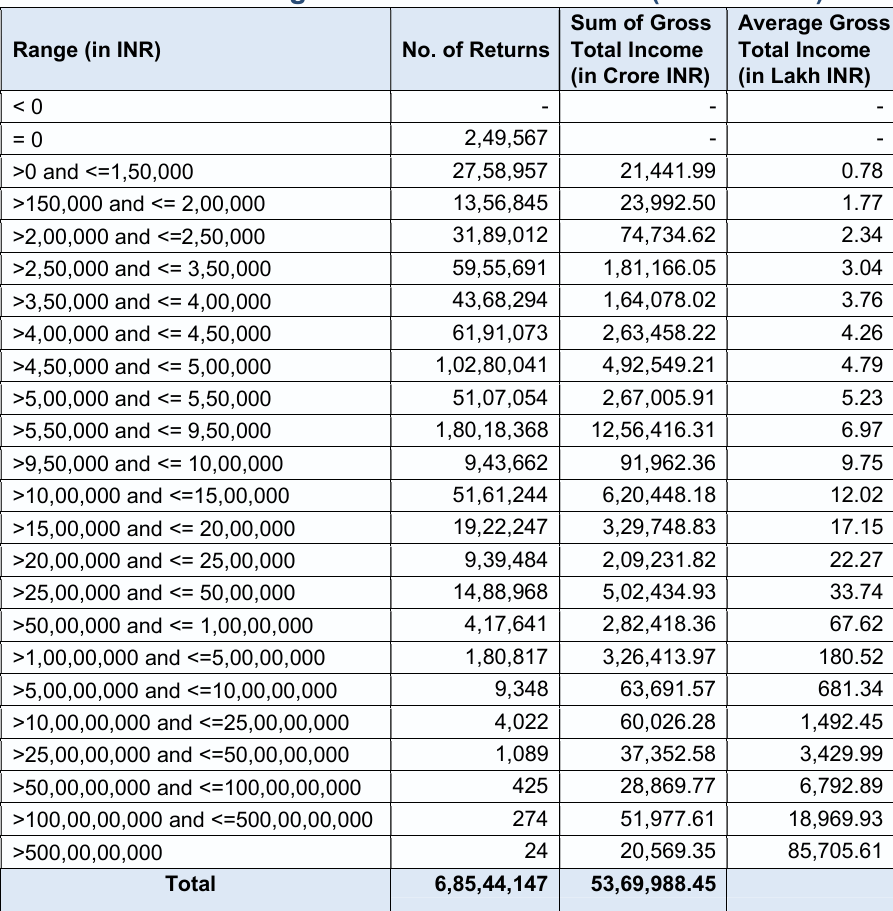

Or look at the Income Tax Return data2 which reveals that only 6,85,44,147 individuals file an income tax return in India. This means that just around 7% of Indian adults file an ITR.

The ‘>450,000’ annual income group is who the mainstream media typically refer to as the ‘middle-class.’ If you sum up everyone with an income greater than 450,000 a year who filed an ITR, you get 44,474,708, or 44 million people. This is the ‘middle-class’ as defined by the business media. That is roughly 4.54% of Indian registered voters.3

So, when you see the ‘middle-class’ complaining on social media about how high income taxes are in India, ask them why they are paying income taxes if they are truly ‘middle-class.’

A fair argument can be made against indirect taxes like the GST. Such taxes are paid by almost everyone. A small indirect tax can be a reasonable way to drive demand for a currency in a country where the vast majority of people work in the informal sector. However, without sufficient government spending on the lower income percentiles, such taxes only further drain consumption demand while exacerbating inequality.

India needs to increase government spending and force employers to pay and treat workers fairly. Even from a ‘selfish’ macroeconomic perspective, making people work 90 hours a week won’t increase GDP. Who will purchase the ‘product’? There isn’t enough external demand, and high levels of private indebtedness mean domestic demand and consumption remain subdued. The only solution is to increase purchasing power.

A Job Guarantee with wages set at the minimum wage would compel all employers to hire workers at that rate. In a country like India, where minimum wage laws are routinely violated, this is essential.

Additionally, farmers’ incomes must be raised by increasing the MSP, cutting out parasitic middlemen, and ensuring they receive basic income support in the event of crop failures.

Unfortunately, given the current political climate, such policies are unlikely to be implemented in India. The country thus appears headed for stagnation.

- https://www.mospi.gov.in/sites/default/files/press_release/HCES_Press_Note_2023-24_27122024_rev.pdf ↩︎

- http://incometaxindia.gov.in/Documents/Direct%20Tax%20Data/Approved-version-Income-Tax-Return-Statistics-for-the-AY-2022-23-14062024.pdf ↩︎

- https://pib.gov.in/PressReleasePage.aspx?PRID=2005189 ↩︎