Note: This is not investment advice; I am simply saying what I believe will happen. Please don’t gamble more than what you can afford to lose. Do not use leverage, and do not gamble on derivatives unless they are properly hedged.

2025 was not a good year for the Indian financial assets market. Foreign capital outflows put downward pressure on share prices, with the NIFTY being up only 10% in the 2025 calendar year.

I do not think this trend will stop this year. Even if India and the U.S. reach a trade deal, there is no reason to believe demand for exports will increase or be higher than it was before the tariff shock. It is abundantly clear that the U.S. is headed for a recession. Their economy will slow down, and when that happens, India’s exports will decrease.

Why do I believe the U.S. is headed for a recession?

-

Multiple Bubbles: There is a very obvious A.I. bubble going on right now, with large amounts of private funds being dumped into a sector whose returns cannot yet be estimated. These expectations will most likely not be realized, and the bubble popping will have an impact on the rest of the economy and the world. Certain commodities like tungsten, gold, and silver are also at record highs; I believe this is unsustainable since, at some point, liquidity will vanish; a situation very analogous to the pre-GFC era when there were massive bubbles in several commodities.

-

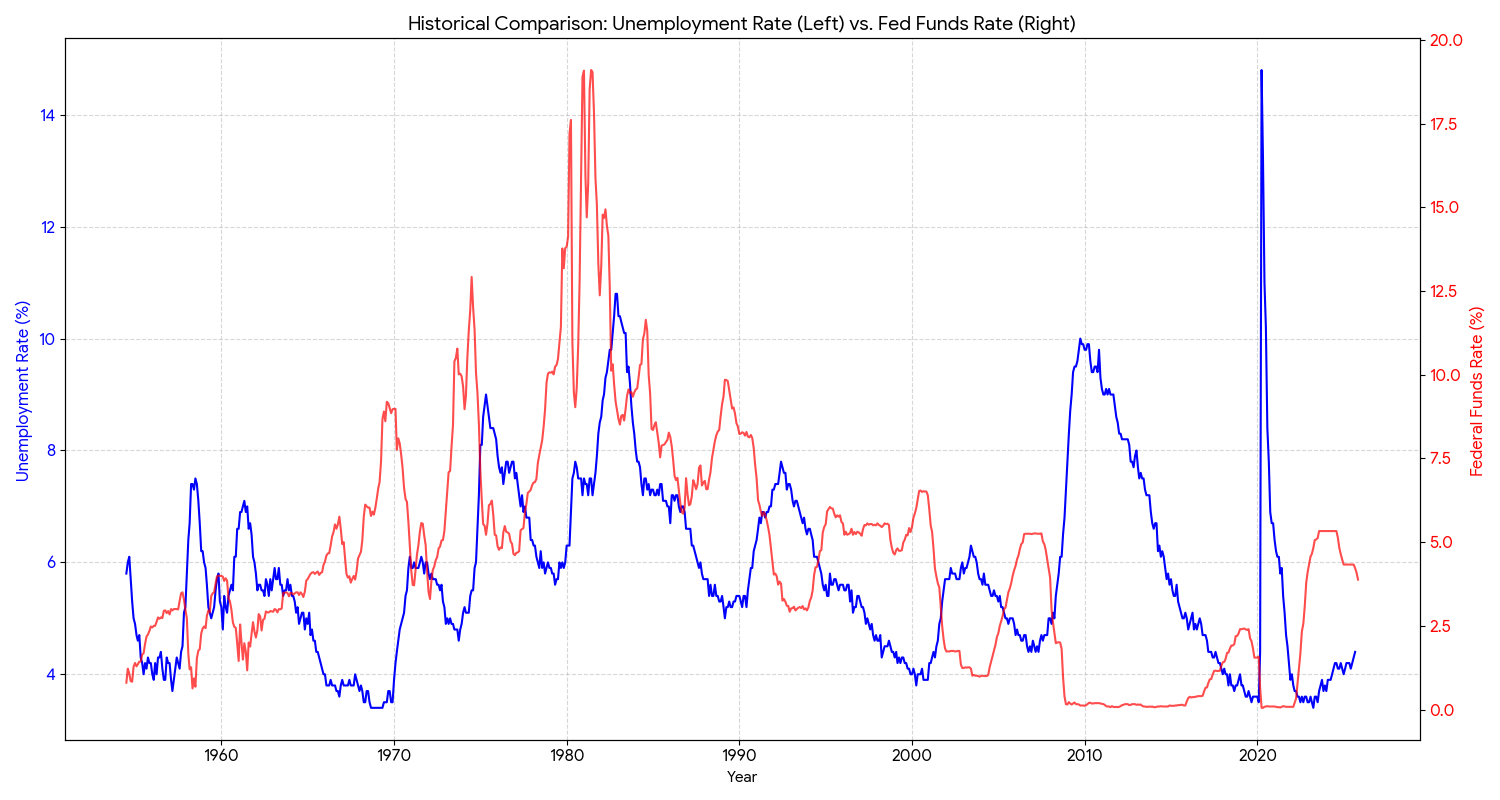

The Federal Reserve is Cutting Rates: The U.S. central bank, the Federal Reserve, has been cutting interest rates since August 2025. Historically, this is followed by a rise in unemployment and a recession. Why? The Fed responds to the U.S. labor market being “too strong” by jacking up rates. In 2022/2023, all the talk was about how the labor market was too tight and how the Fed should keep raising rates. Now, due to Trump tariffs and weak fiscal injections from the U.S. government, unemployment has been rising in the U.S. from 3.4% in April 2023 to 4.6% in November 2025. This is likely only the beginning.

- Pressure on Aggregate Demand: Many of the actions by the Trump admin put further pressure on aggregate demand. For instance, tariffs are a direct drain on demand. They are also deducting student loan debt payments directly out of peoples’ accounts, and the OBBB has been a disaster as it raised healthcare costs; costs which move from consumers to hoarders.

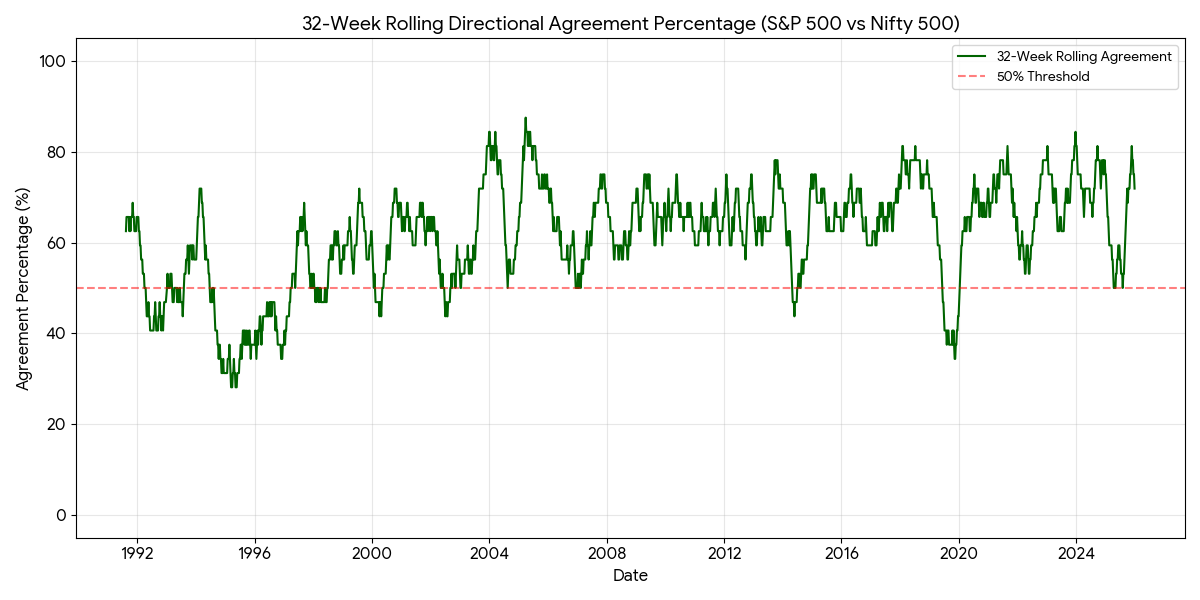

- Market Correlation: You might say, “I don’t care about the U.S. market; what does this have to do with India?” Historically, Indian and American share markets are highly correlated directionally. Therefore, you should care about how the U.S. economy and market are performing.

Given these circumstances, what is to be done?

Here’s what I would do:

I. De-risking: I would sell all the shares I own and put the money into sovereign debt funds (i.e., Government bonds). Certain Rupee-denominated corporate bonds might also be worth it; even with the credit risk, they will have higher yields. This is called de-risking. It is not speculative; I am simply looking at macroeconomic conditions and saying, “This won’t be good for my portfolio; I will switch to safer assets.”

II. Crystallizing Gains: I would crystallize the gains made in the share market. I may lose further upside if stocks go up further, but I will save much more of my financial wealth if shares go down in a crash.

How will I make gains when the market crashes? Given that it is impossible to predict the bottom of a share price due to fundamental uncertainty, I will start what is known in India as SIP, where I will buy a set amount of a broad-based NIFTY ETF/Mutual Fund. I would also look at the P/E ratio; this will tell me whether I should increase my SIP amount. I will double it when the crash becomes clearer.

This way, I will Dollar-Cost-Average (DCA). The formula automatically ensures that your flow of funds gets you more units of shares when prices are low and fewer when the prices are high. This is, in many ways, similar to an “automatic stabilizer” in macroeconomics; where, for instance, income tax revenue goes down automatically during a recession. By following this strategy, I will capture the “dip” in share prices if and when the prices drop sharply, all while reducing risk.

I will also diversify into other markets; the U.S. offers a similar opportunity. This will help hedge against currency depreciation and generate returns at the same time, using a similar DCA strategy.

That’s all.